Softbank to Receive $34 Billion from Alibaba Sale, Share Ownership Decreases from 23.7% to 14.6%

11th August 2022 | Hong Kong

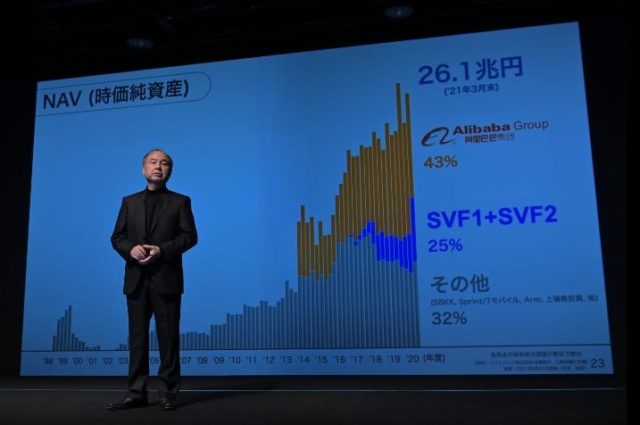

Softbank will be receiving $34 billion from the sale of Alibaba Group via forward contracts with the early settlement of 242 million ADRs, and its ownership (including subsidiaries) from Alibaba to decrease from 23.7% to 14.6%. Earlier in August 2022, Softbank had reportedly sold around $22 billion of Alibaba forward contracts, reducing its Alibaba holdings by more than 50% through the forward contracts. According to the Financial Times report: ”Softbank could shrink its stake below the threshold for retaining its board seat and prevent it from including its share of Alibaba’s income in financial statements.” Earlier in 2022 May, Japanese billionaire Masayoshi Son’s SoftBank Vision Funds had recorded $27 billion of losses (JPY 3.5 trillion) for the year ending 2022 March. At the 2022 earnings presentation, Softbank Masayoshi Son: ”We, SoftBank, should be taking defense.” SoftBank portfolio includes Coupang (-80%), GRAB (-79%) and Didi (-90%) which had performed badly since IPO and also key stake in Alibaba which had been impacted by China government clampdown on technology sector. Masayoshi Son is one of Japan’s top 10 richest man with around $22 billion of personal fortune. See below for Softbank full statement

“ Softbank to Receive $34 Billion from Alibaba Sale, Share Ownership Decreases from 23.7% to 14.6% “

Softbank Statement

Physical Settlement of Alibaba Prepaid Forward Contracts, and Transfer of Alibaba Shares to Finance Subsidiaries Related to the Settlement

SoftBank Group Corp. (“SBG”) announces that its Board of Directors today approved 1) the early physical settlement (the “Physical Settlement”)*1 of prepaid forward contracts corresponding to a maximum of approx. 242 million ADRs of Alibaba Group Holding Limited (“Alibaba”), an equity method associate of SBG, executed with several financial institution counterparties to raise funds using Alibaba shares held through several of SBG’s wholly owned subsidiaries (collectively the “Finance Subsidiaries,” and individually, each a “Finance Subsidiary”), and 2) the transfer of Alibaba shares to the Finance Subsidiaries in relation to the Physical Settlement.

The Physical Settlement will take place sequentially at each Finance Subsidiary beginning in mid-August 2022, and is expected to be completed by the end of September 2022.*2 SBG expects that the Physical Settlement of these prepaid forward contracts will not result directly in any additional sales of Alibaba shares at each financial institution counterparty into the market, as Alibaba shares subject to these prepaid forward contracts were hedged in the market at the time of the original monetization transactions by each financial institution counterparty.

SBG expects that Alibaba shares beneficially owned by SBG (including shares subject to continuing monetization transactions) will correspond to 14.6%*3 following the Physical Settlement, a decrease from 23.7%*4 as at the end of June 2022, of the total outstanding shares of Alibaba, which is a decrease below the 20% voting right holding ratio required to be deemed as an equity method associate.

1. Purpose of the Physical Settlement

The current equity market environment is challenging and may be prolonged. The Finance Subsidiaries can choose to settle such prepaid forward contracts in cash or physical form (or any combination thereof), however, considering the said market environment, SBG has determined that the best option at this time is to settle these prepaid forward contracts in physical form. By settling these contracts early, SBG will be able to eliminate concerns about future cash outflows, and furthermore, reduce costs associated with these prepaid forward contracts. These will further strengthen our defense against the severe market environment.

As detailed in “3. Impact on consolidated and non-consolidated financial results,” the early Physical Settlement of the prepaid forward contracts and the transfer of Alibaba shares to the Finance Subsidiary are expected to have a positive impact on income before income tax in the consolidated and non-consolidated statements of profit or loss. However, these gains are the realization by the Physical Settlement and recognition of unrealized gains that have not yet counted due to Alibaba’s status as an equity method associate of SBG.

SBG made its first investment in Alibaba in 2000 and has since developed a close relationship with Alibaba over the years. After the Physical Settlement, Alibaba is expected to cease to be an equity method associate of SBG, but SBG will continue to maintain a good relationship with Alibaba.

2. Overview of the Physical Settlement and the transfer of Alibaba shares to Finance Subsidiaries

1) SBG will transfer to each Finance Subsidiary at fair value the shares of Alibaba common stock up to an aggregate of approx. 1,936 million shares, which are equivalent to a maximum of approx. 242 million ADRs.

2) Each Finance Subsidiary will make a sequential physical settlement of its respective prepaid forward contract from mid-August 2022 onward. The total number of Alibaba shares required for the Physical Settlement is a maximum of approx. 242 million ADRs. SBG expects that the Physical Settlement of these prepaid forward contracts will not result directly in any additional sales of Alibaba shares by each financial institution counterparty into the market, as Alibaba shares subject to these prepaid forward contracts were hedged in the market at the time of the original monetization transactions by each financial institution counterparty.

3. Impact on consolidated and non-consolidated financial results

A) Consolidated financial results

SBG recorded net loss of 5.3 trillion yen in total for the three-month periods ended March 31, 2022 and June 30, 2022, however, as a result of the Physical Settlement, uncounted gains from the previous periods will be recorded as follows.

1) Consolidated statement of profit or loss

- SBG expects to record (a) a gain relating to settlement of prepaid forward contracts using Alibaba shares, (b) a gain on revaluation of Alibaba shares, and (c) a derivative gain (excluding gains and losses on investments) for the three-month period ending September 30, 2022 (the second quarter of the fiscal year ending March 31, 2023). However, these gains are the realization by the Physical Settlement and recognition of unrealized gains that have not yet counted due to Alibaba’s status as an equity method associate of SBG.

- SBG will announce the impact on the consolidated financial results once finalized, however, based on the assumptions below, the following gains are estimated to be recorded.*5

| Estimated gain before tax expenses | |

| (a) Gain relating to settlement of prepaid forward contracts using Alibaba shares | Approx. JPY 1.5 trillion |

| (b) Gain on revaluation of Alibaba shares | Approx. JPY 2.4 trillion |

| (c) Derivative gain (excluding gains and losses on investments)

* a gain on prepaid forward contracts that are the subject of the Physical Settlement |

Approx. JPY 0.7 trillion |

| Total (contribution to income before income tax) | Approx. JPY 4.6 trillion |

- •The contribution to net income attributable to owners of the parent is after deducting tax expenses from the above amounts.

SBG makes the following assumptions to estimate the above gains:

i. The number of Alibaba shares to be used for settlement is approx. 242 million ADRs,

ii. The fair value per share (share price) of Alibaba shares at the time of settlement and on the date when Alibaba is excluded from SBG’s equity method associates is USD 91.19 per ADR, which is the closing price on August 9, 2022,

iii. Exchange rate of USD 1= JPY 134.89, which is TTM on August 9, 2022, and

iv. The consolidated carrying amount per Alibaba share is USD 43.97 per ADR, which is based on the consolidated carrying amount as of June 30, 2022.

- (a) is calculated by multiplying the difference between the consolidated carrying amount per share and the fair value per share (share price) at settlement by the number of Alibaba shares (ADRs) underlying the prepaid forward contracts. (b) is calculated by multiplying the difference between the consolidated carrying amount per share and the fair value per share on the date of exclusion from the equity method associates by the number of Alibaba shares (ADRs) that SBG continues to hold. (c) represents the change in fair value of derivative financial assets and liabilities from June 30, 2022 to the settlement date, and the fair value of derivative financial assets and liabilities at settlement is calculated by multiplying the difference between the settlement price per share and the fair value per share (share price) at settlement by the number of Alibaba shares (ADRs) underlying the prepaid forward contracts.

- After Alibaba is excluded from SBG’s equity method associates, the quarterly changes in the fair value of the Alibaba shares that SBG continues to hold after the Physical Settlement will be recorded in the consolidated statement of profit or loss as “gain on investments at Investment Business of Holding Companies.”

2) Consolidated statement of financial position

- SBG will derecognize financial liabilities relating to sale of shares by prepaid forward contracts of JPY 2,798.2 billion, derivative financial assets of JPY 313.1 billion, and derivative financial liabilities of JPY 286.2 billion, related to such prepaid forward contracts that were recorded in the consolidated statement of financial position as of June 30, 2022. The assumptions for the number of Alibaba shares to be used for settlement are the same as in (i) under 1) above.

- Upon the exclusion of Alibaba from SBG’s equity method associates, all Alibaba shares included in investments accounted for using the equity method in the consolidated statement of financial position (beneficially ownership: 23.7%,*4 balance as of June 30, 2022: JPY 4,566.1 billion) will be derecognized. Alibaba shares that SBG continues to hold (beneficially ownership: 14.6%*3) will be revalued at fair value and recorded as investment securities (estimated amount based on the above assumptions: approximately JPY 4.8 trillion*5).

B) Non-consolidated financial results

In connection with the transfer of Alibaba shares from SBG to the Finance Subsidiaries as described in 1) of “2. Overview of the Physical Settlement and the transfer of Alibaba shares to Finance Subsidiaries,” a gain on sale of shares (extraordinary income) will be recorded for the fiscal year ending March 31, 2023 (12-month period ending March 31, 2023). The amount of the gain on sale of shares will be obtained by multiplying the difference between the carrying amount per share and the fair value per share (share price) at the time of sale to the Finance Subsidiaries multiplied by the number of Alibaba shares transferred. The impact on the non-consolidated financial results will be announced once finalized, but based on the following assumptions, the gain is estimated to be approximately JPY 2.4 trillion (before tax expenses).*5

SBG makes the following assumptions to estimate the above gains:

i) The number of Alibaba shares to be transferred to the Finance Subsidiaries is approx. 1,936 million shares of common stock (equivalent to approx. 242 million ADRs),

ii) The fair value per share on the date of such transfer is USD 91.19 per ADR, which is the closing price on August 9, 2022,

iii) Exchange rate of USD 1 = JPY 134.89, which is TTM on August 9, 2022, and

iv) The carrying amount per Alibaba share is JPY 306 per common stock, which is equal to the carrying amount at the time of transfer.

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit