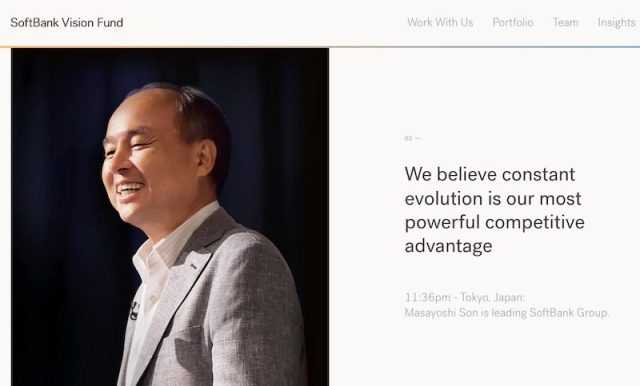

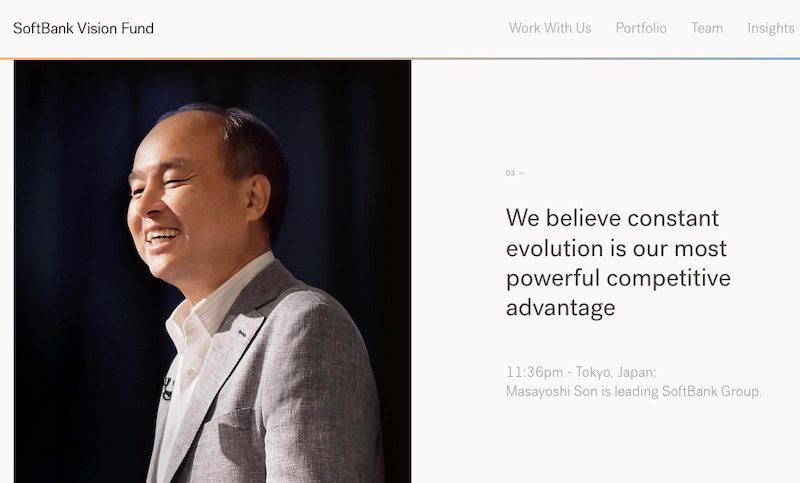

Masayoshi Son SoftBank Review Plans to Launch Softbank Vision Fund 3 in 2023, Fund 1 Raised $100 Billion in 2017

15th September | Hong Kong

Japanese billionaire Masayoshi Son’s SoftBank is reviewing plans to launch Softbank Vision Fund 3 in 2023. In 2017, SoftBank Group Corp created the SoftBank Vision Fund 1, raising $100 billion and Fund 2 was created in 2019. Earlier in May 2022, SoftBank Vision Funds recorded $27 billion of losses (JPY 3.5 trillion) for the year ending 2022 March. At the 2022 earnings presentation, Softbank Masayoshi Son: ”We, SoftBank, should be taking defense.” SoftBank portfolio includes Coupang (-80%), GRAB (-79%) and Didi (-90%) which had performed badly since IPO and also key stake in Alibaba which had been impacted by China government clampdown on technology sector. In August 2022, Softbank announced it will be receiving $34 billion from the sale of Alibaba Group via forward contracts with the early settlement of 242 million ADRs, and its ownership (including subsidiaries) from Alibaba to decrease from 23.7% to 14.6%. Masayoshi Son is one of Japan’s top 10 richest man with around $22 billion of personal fortune. SoftBank Vision Fund (SVF) 1 and Fund 2 seek to accelerate the AI revolution through investments in market-leading, tech-enabled growth companies, particularly in private companies valued at over $1 billion at the time of investment, colloquially known as “unicorns.” See below: In 2017, SoftBank Group Corp created the SoftBank Vision Fund 1, and Fund 2 was created in 2019.

“ Masayoshi Son SoftBank Reviewing Plans to Launch Softbank Vision Fund 3 in 2023 “

In 2017: SoftBank Group Corp created the SoftBank Vision Fund

SoftBank Group Corp created the SoftBank Vision Fund as a result of its strongly held belief that the next stage of the Information Revolution is underway, and building the businesses that will make this possible will require unprecedented large scale long-term investment. Additionally, the Fund’s portfolio companies are expected to significantly benefit from SBG’s global scale and operational expertise, as well as its ecosystem of group portfolio companies (including Sprint and Yahoo Japan); this will thereby help them to accelerate their own growth profile. The Fund will be SoftBank Group Corp primary vehicle to realise its SoftBank 2.0 vision, with preferred access to investments of $100 million or more that meet the Fund’s investment strategy. SoftBank Vision Fund 2 was created in 2019.

SoftBank Vision Fund (SVF) 1 and 2 seek to accelerate the AI revolution through investments in market-leading, tech-enabled growth companies, particularly in private companies valued at over $1 billion at the time of investment, colloquially known as “unicorns.” Their global reach, unparalleled ecosystem and patient capital help founders build transformative businesses.

Masayoshi Son, Chairman & CEO of SoftBank Group Corp

“Technology has the potential to address the biggest challenges and risks facing humanity today. The businesses working to solve these problems will require patient long-term capital and visionary strategic investment partners with the resources to nurture their success. SoftBank has long made bold investments in transformative technologies and supported disruptive entrepreneurs. The SoftBank Vision Fund is consistent with this strategy and will help build and grow businesses creating the foundational platforms of the next stage of the Information Revolution.”

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2024 Investment Day

- March 2024 - Hong Kong

- March 2024 - Singapore

- June 2024 - Hong Kong

- June 2024 - Singapore

- Sept 2024 - Hong Kong

- Sept 2024 - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Investment Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit