Hedge Funds Global AUM at $3.55 Trillion in 2021 1H, Net Inflow of $28.69 Billion

30th July 2021 | Hong Kong

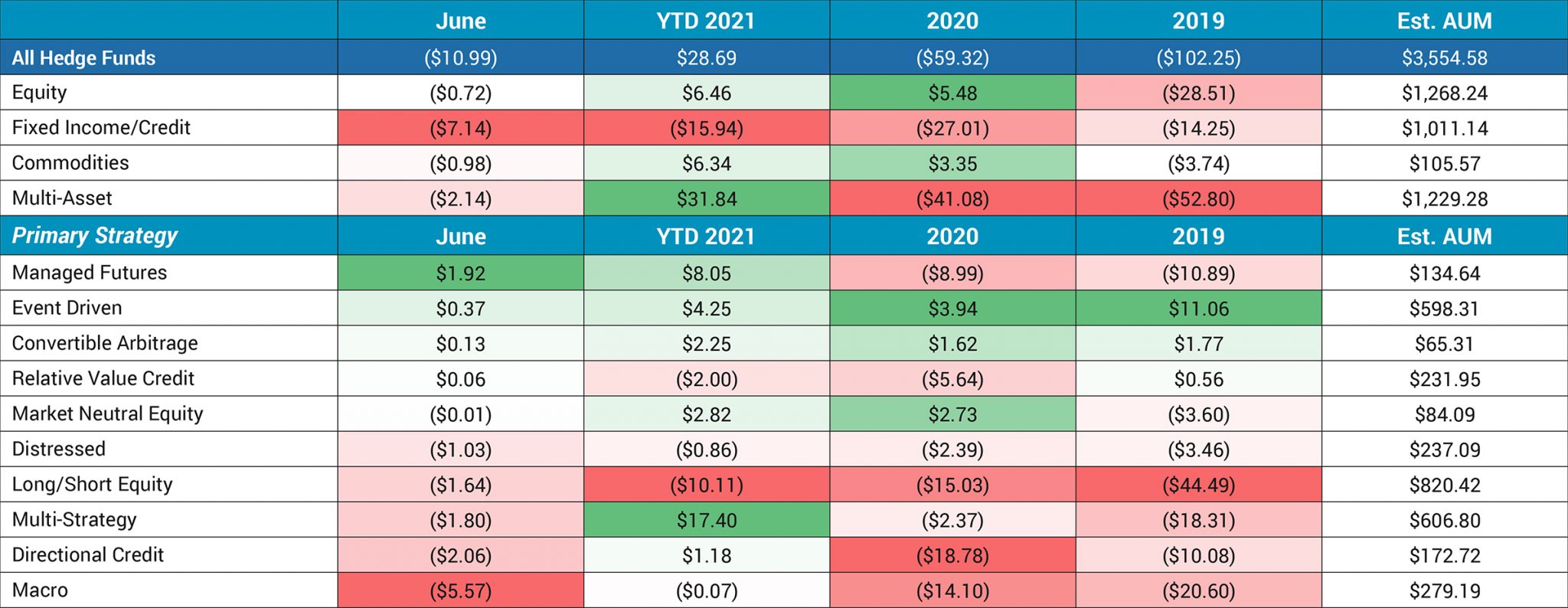

The global hedge funds industry AUM is estimated to be $3.55 trillion in 2021 1st half, with a total net inflow of $28.69 billion representing an increase of 0.8% from the end of 2020. In the month of June 2021, hedge funds saw an outflow of $10.99 billion, with Fixed Income / Credit continuing a 3 years net outflow of $15.94 billion in 2021 (Outflow 2019: $14.25 billion, 2020: $27.01 billion, 2021 YTD: $15.94 billion). Hedge funds allocation into Multi-Asset gained the most with $31.84 billion net inflow in 2021 1st half. The top 5 largest hedge fund strategy by allocation are: Equity ($1.26 trillion), Multi-Asset ($1.22 trillion), Fixed Income / Credit ($1.01 trillion), Long/Short Equity ($820 billion) and Multi-Strategy ($606 billion). (AUM ~ Asset under Management)

” Hedge Funds Global AUM at $3.55 Trillion in 2021 1H, Net Inflow of $28.69 Billion “

2021 June – Hedge Fund Allocation by Strategy

The top 5 largest hedge fund strategy by allocation are:

- Equity ($1.26 trillion)

- Multi-Asset ($1.22 trillion)

- Fixed Income / Credit ($1.01 trillion)

- Long/Short Equity ($820 billion)

- Multi-Strategy ($606 billion)

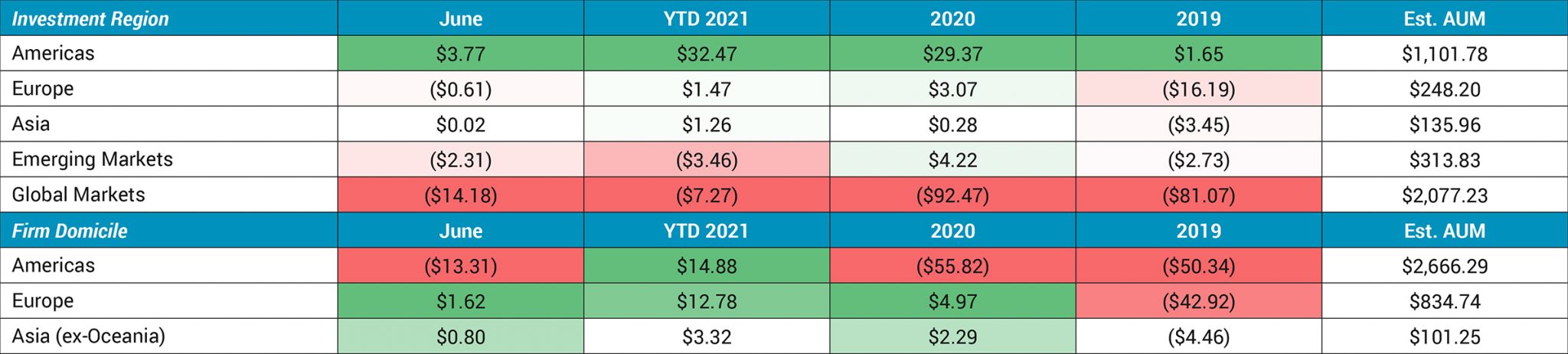

2021 June – Hedge Fund Allocation by Region

Source: Peter Laurelli, Evestment Global Head of Research

Related:

- 2021 Q1 Global Hedge Funds AUM at $4.1 Trillion, $162 Billion AUM in APAC

- 2020 Private Markets & Alternatives Assets in Asia AUM at $1.7 Trillion

- Private Markets, Alternatives Assets in Asia to Reach $6 Trillion by 2025

- 2020 China Private Equity and Venture Capital AUM at $1.04 Trillion, Southeast Asia at $33 Billion

- 2021 Q1 Global Hedge Funds AUM at $4.1 Trillion, $162 Billion AUM in APAC

- 2020 Sovereign Wealth Fund AUM at $7.84 Trillion, Norway Largest with $1.27 Trillion

More:

- Mercer: White Paper on Optimizing Portfolio in Private Markets for LPs in 2021

- BlackRock and iCapital Network to Provide Wealth Managers with Access to Private Market Investments

- Credit Suisse Appoints Alois Müller as Head of Private & Alternative Markets APAC, Target $7.8 Billion Assets Yearly

- UBS and Partners Group to Give UBS Clients Access to Private Markets Investments

- $9 Trillion Asset Manager BlackRock, CCB & Temasek JV Receives License for Wealth Management in China

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit