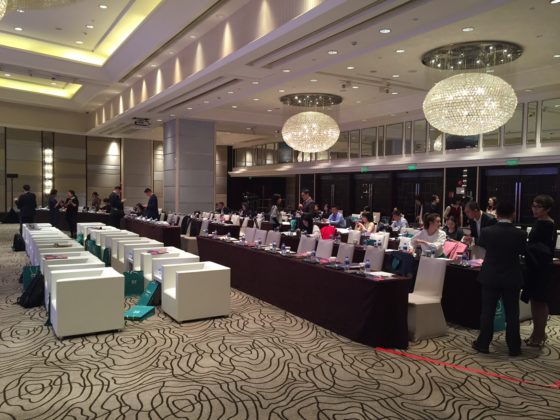

Highlights from the Wealth Management & Private Banking Asia Conference 2016

On 1st and 2nd December 2016, top Wealth & Private Banking professionals attended the the 10th Annual Wealth Management & Private Banking Asia Conference 2016 at the Intercontinental Hotel in Shanghai, China. The event was organised by Shine Consultant International

The event is attended by many of the Wealth Management & Private Banking top professionals including:

- Kang Chaofeng, Managing Director of Wealth Product Investment (Ping An Trust)

- Joy Hu, General Manager of Family Wealth Shanghai (ICBC)

- Nick Yim, Head of North East Asia Region Private Wealth Mgmt (Goldman Sachs)

- Jacky Tang, Head of Portfolio Management (Goldman Sachs)

- Steven Zhang, Chief Economist (Morgan Stanley Huaxi Securities)

- Michael Haupt, Chief Operating Officer (Vontobel Private Banking)

- David He, Partner and Managing Director (Boston Consulting Group)

- Zhang Guanping, Deputy Director-General (China Banking Regulatory Commission)

- and many more … …

Exiting Times Ahead in China

In the opening remark, Zhang Guangping, Deputy Director-General of China Banking Regulatory Commission discussed about China’s economic and capital market transformation: “The first 10 years is exciting. The next 10 will be even more exciting.”

Where Chinese Buy Real Estate

Rupert Hoogewerf, CEO & Top Researcher of the Hurun Report, provided rich insights of the wealth growth in China, how the rich create their wealth and what they do with their wealth. Significantly, ” the Chinese global citizen buy most of their real estate in North America ”

Where the Chinese Global Citizens buy their houses:

| Rank | Destinations | % |

| 1 | Los Angeles | 17.80% |

| 2 | San Francisco | 13.20% |

| 3 | Seattle | 12.80% |

| 4 | New York | 11.60% |

| 5 | Boston | 7.20% |

| 6 | Vancouver | 7.10% |

| 7 | Sydney | 3.90% |

| 8 | New Zealand | 3.80% |

| 9 | Melbourne | 3.80% |

| 10 | Toronto | 2.70% |

| 11 | Singapore | 2.20% |

| 12 | Chicago | 1.90% |

| 13 | Malta | 1.80% |

| 14 | London | 1.40% |

| 15 | Japan | 1.20% |

Source: Hurun Report

Infrastructure between China & United States

Adding onto the growing economic strength of China, Steven Zhang, Chief Economist of Morgan Stanley Huaxi Securities compared China and United States of America’s economic growth prospect:” China have high quality infrastructure to the 3rd-tier cities. America infrastructure is old.”

Click on the image to view

KYC Questions in Question

In discussing about providing quality wealth advice to clients, KANG Chaofeng, Managing Director for Wealth Product Investment Strategy of Ping An Trust illustrated the concerns of KYC: “How much risk can you take? How much loss can you absorb? These are useless KYC questions.”

It’s Always Too Late

The 2 days Wealth Management and Private Banking Conference rounded up in reference to a high profile divorce case in China where ZHAO Zhimin, Vice GM Marketing and GM of Shanghai Private Wealth Center for CITIC Trust described: ” Clients are busy with their businesses. They have no time to discuss about family trust planning. By the time they need it, it’s already too late.”

It’s Also Getting Easier

Perhaps, access to financial services and advice is not too difficult anymore when Ray Chou, Principal of Bain & Company remarked in the closing panel discussion:” If the clients can’t reach their Private Bankers, they can use now e-banking or access digital applications.”

By Caproasia Online

More upcoming events at The Events Page

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit