What is an Insurance Specialist?

The name speaks for itself – An Insurance Specialist deals in insurance, ensuring risks is being managed. In traditional wealth management, risks is often viewed as insurance against death. Today, risks has becoming increasingly complex. Tax risks, business risks, investment risks are important risks that clients, banks and wealth management service providers look at.

Today, risks has becoming increasingly complex.

What exactly is an Insurance Specialist?

An Insurance Specialist provides risk management advice to clients and wealth managers.

Examples of risk management are: Death, accidentals, emergency needs, cashflow needs, investment, credit, loan defaults, family, business and tax risks.

What does a Insurance Specialist do?

An Insurance Specialist has specialised knowledge in risk management. A cornerstone of wealth management is to manage the risk of life and investment.

Most clients look at only investment returns, neglecting short-term sudden cash needs due to accidents, death or even liquidity issues. The Insurance Specialist understand these risks, and carefully craft a comprehensive solution that integrates well with the client’s portfolio.

Did you know

Maritime insurance is the earliest known insurance contract. It was started in Genoa in 1347.

What are the products an Insurance Specialist work with?

There are many products under risk management:

Basic Products: Term Insurance, Whole-life Insurance, Endowment, Investment-Linked Policies

Advanced Products: Universal Life, Key-man Insurance, Mortgage Insurance, Company Formation, Trust Services

Insurance Specialist work closely with team members such as Wealth Managers, Investment Advisors and Loan Specialists. Understanding the financial needs and wealth solutions implemented, the insurance specialist provides

Why do we hear of Bancassurance Specialist?

Bank + Insurance = Bancassurance

There are similar job titles such as Bancassurance Specialist, Insurance Advisor or Financial Protection Specialist.

Financial Protection Specialist in OCBC Bank

OCBC Bank is owned by OCBC Group which owns Great Eastern Life Insurance. Great Eastern is the largest insurance group in Singapore and Malaysia in terms of assets and market share. Its agency force in Singapore and Malaysia is about 20,000-strong.

What is the career progression for an Insurance Specialist?

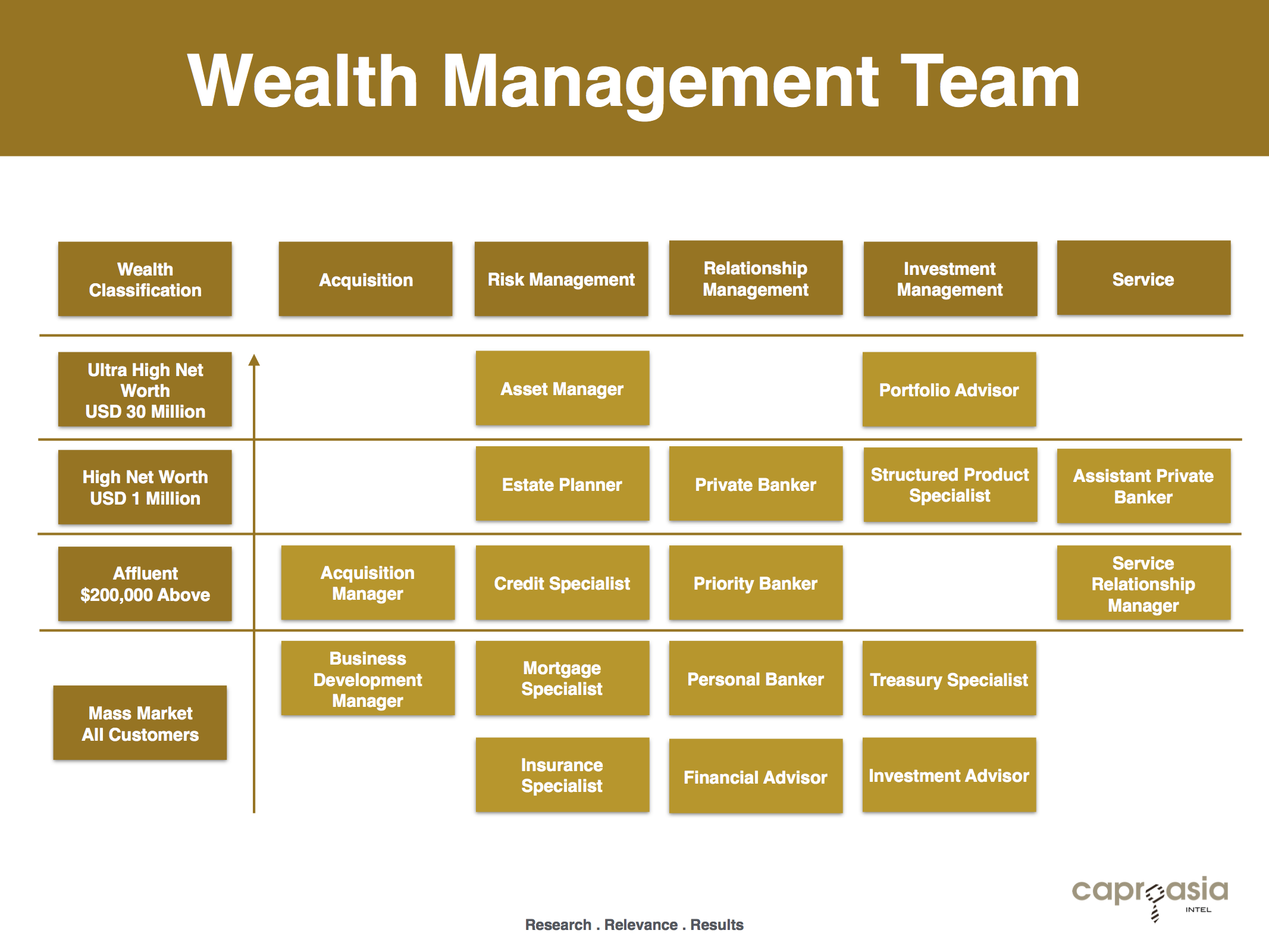

An Insurance Specialist can choose to remain as an Insurance Specialist providing solutions to different segment of clients in mass market, affluent or to High Net Worth clients. Roles such as Estate Planner or Asset Manager provides a larger role not limiting to risk management but also to complex investment & tax structures & company formation.

He or she can move into other product roles such as Mortgage or Credit Specialist, or move into Relationship Management roles such as Personal Banker or Priority Banker.

See below for Wealth Management Team setup and career options.

To learn more about Wealth Management Career, visit Career Center

Related Articles:

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit