What is an Investment Advisor?

An Investment advisor provides investment and portfolio advice and is the main source of financial market info and economic trends to the Relationship Manager (Personal Bankers, Priority Bankers, Private Bankers, Wealth Managers) and the clients.

The Investment Advisor keeps track of the latest financial news, interest rates hike/cut, major economic indicators, stock surge & crashes, IPOs, bankruptcies and anything that impacts investment & portfolio decisions.

- Where can you start as a Wealth Manager in Banking?

- 10 Popular Job Titles in Wealth Management

- What does a Relationship Manager do?

- Part I: So you got your new job as a Relationship Manager. What is next?

- Part II: So you got your new job as a Relationship Manager. What is next?

What exactly is an Investment Advisor?

The Investment Advisor is the investment expert providing investment advisory to the Relationship Manager and the client. The discussions, analysis and recommendations can result in a construction of a portfolio for clients.

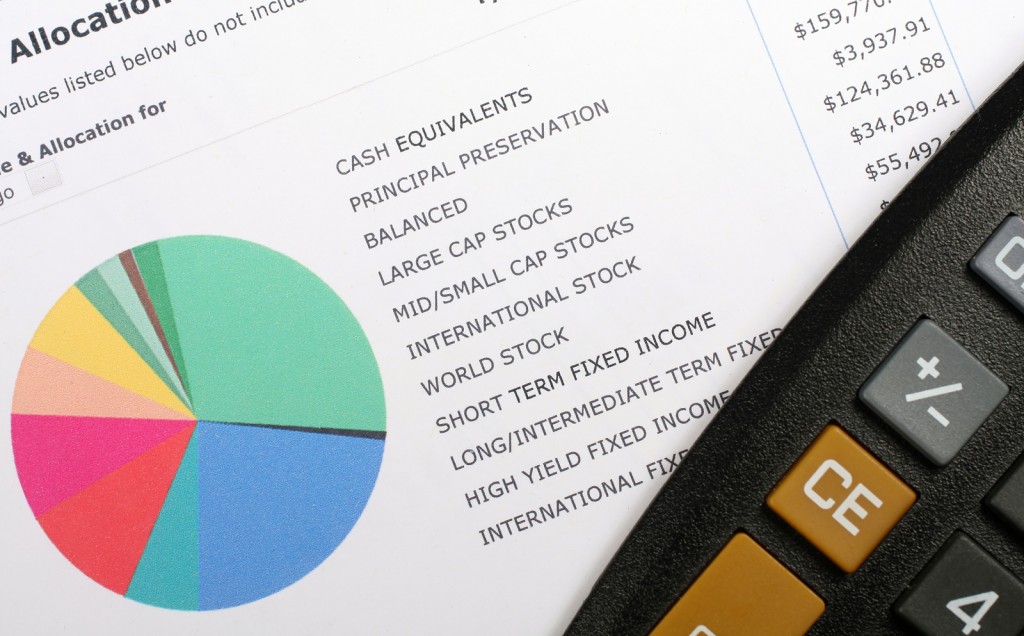

Example of Asset Classes:

- Equities

- Bonds / Fixed Income

- Money Market / Cash Equivalents

- Commodities

- Real Estate

Example of Investment Instruments:

- Securities

- Unit Trusts

- Exchange Traded Funds

- Structured Products

- Derivatives (Options, Futures, Forwards)

Example of Portfolio Construction:

| Asset | Instrument | Allocation |

| Cash | Deposits | 20% |

| Equities | Unit Trust | 20% |

| Equities | Equity Linked Notes | 10% |

| Equities | Securities | 10% |

| Bonds | Unit Trust | 10% |

| Bonds | Securities | 10% |

| Mixed | Unit Trust | 10% |

| Mixed | Structured Products | 10% |

| 100% |

What does an Investment Advisor do?

Investment Advisor works closely with Relationship Managers and Product Specialists (Treasury Advisor, Insurance Specialist, Credit Specialist) to formulate investment & portfolio advice to clients.

This includes preparation work such as financial market review, reviewing portfolios & investments and preparing proposals. They will follow up and meet clients with Relationship Managers, do conference calls or pass on the proposals & recommendations to Relationship Managers if they are unable to attend the meetings.

The Investment Advisor also keeps up-to-date with the financial markets, industry and product developments through conferences, meetings, training and reading.

- 8 Reasons why building a Portfolio is tough in Asia

- 3 Reasons why Good investment idea may be a Bad idea

What are the products an Investment Advisor work with?

This depends which segment of Wealth Management is the Investment Advisor is in:

- Personal Banking

- Priority Banking

- Private Banking

- Independent Financial Advisory

- Family Office

Common investment products include bonds, equities, Unit Trust, Exchange Traded Funds and Structured Products. In Private Banking & Family Offices, they may also work on Hedge Funds and Private Equity.

Who does an Investment Advisor work with?

The Investment Advisor typically reports to the Head of Investment Advisory or the Head of Investments / Products.

The Investment Advisor works with Investment specialists in equities, fixed income, foreign exchange, treasury, commodities, funds, structured products. Other specialists includes Bancassurance and Credits.

They also meet Chief Investment Officers, Chief Economists, Head of Equities, Head of Fixed Income, Head of Treasury, Head of Foreign Exchange and externally, Fund Managers.

At the forefront of Wealth Management, Investment advisors work closely with Relationship Managers and clients to provide investment and portfolio advice.

- What is a Personal Banker?

- What is a Priority Banker?

- What is a Private Banker?

- What is an Insurance Specialist?

- 5 Types of Financial Institutions to join as a Wealth Manager

What is the career progression for an Investment Advisor?

An Investment Advisor can continue to be an Investment Advisor, constantly upgrading his/her knowledge. Since Wealth Management is an important service in mass market, affluent market and high net worth market, Investment Advisor can also move to different client segment to offer different investment advice to clients.

An Investment Advisor can also take on larger responsibility by becoming the Head of Investment Advisory, overseeing a team of Investment Advisors and coordinating clients & sales feedbacks, product developments and marketing activities. There’s also opportunities to move into specialists products such as Treasury, Equities, Fixed Income, Funds, Structured Products, Portfolio Management and less investment oriented roles such as Bancassurance, Credit and Estate Advisory.

The Investment Advisor can also become Relationship Managers (Personal Bankers, Priority Bankers, Private Bankers) and non-banking Wealth Managers in Independent Financial Advisory Firms.

Related Articles:

- What is an Investment Advisor?

- How do you become an Investment Advisor?

- What does an Investment Advisor do?

- What are the challenges of an Investment Advisor?

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit