Singapore $500 Billion Sovereign Wealth Fund GIC Achieved 6.8% Annualised Return over 20 Years

23rd July 2021 | Singapore

Singapore sovereign wealth fund (SWF) GIC has achieved 6.8% annualised return (nominal) and 4.3% real rate of return (adjusted for inflation) over the last 20 years ending 31st March 2021. Singapore sovereign wealth fund (SWF) GIC mandate is to preserve and enhance the international purchasing power of the reserves under its management over the long term (achieve good long-term returns over global inflation). Sovereign Wealth Fund Institute estimates Singapore’s GIC portfolio value at more than $500 billion ($545 billion). View: GIC Report

” Singapore $500 Billion Sovereign Wealth Fund GIC Achieved 6.8% Annualised Return over 20 Years “

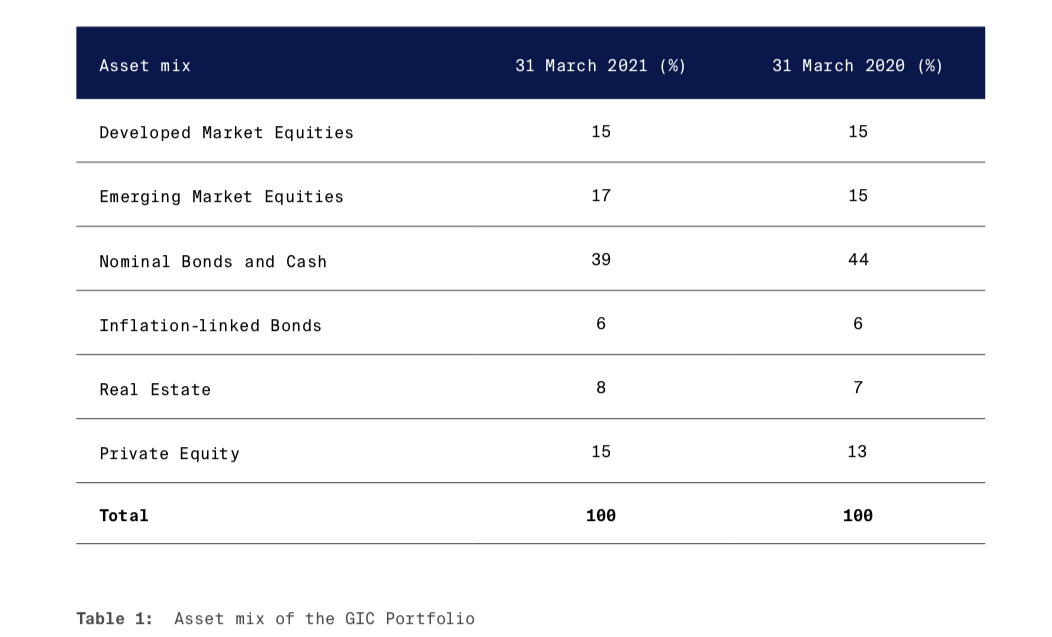

GIC Portfolio Allocation

Related:

- Singapore Sovereign Wealth Fund Temasek Grows Portfolio to $283 Billion, 24% Return YOY

- Qatar $328 Billion Sovereign Wealth Fund Setup Office in Singapore

- 2020 Sovereign Wealth Fund AUM at $7.84 Trillion, Norway Largest with $1.27 Trillion

- Singapore MAS FY2020/2021 Report: AUM Reaches $3.48 Trillion

- Indonesia President Jokowi Targets $200 Billion Sovereign Wealth Fund

- New Indonesia Sovereign Wealth Fund Grows Assets to $15 Billion, Appoints First CEO

- Norway $1.05 Trillion Sovereign Wealth Fund Appoints Nicolai Tangen as New CEO

GIC 40th Anniversary, Since 1981

2021 is the 40th anniversary of GIC. In 1981, Singapore founding leaders, the late Lee Kuan Yew and Dr Goh Keng Swee, entrusted GIC (Government of Singapore Investment Corporation) with the mission to preserve and enhance the value of Singapore’s foreign reserves. The founding team built GIC from scratch – with the late Yong Pung How beginning his tenure with only a desk and an unusable telephone.

Today, GIC has assets in over 40 countries and offices in 10 key financial cities with capabilities to invest across a wide range of asset classes, including equities, fixed income, private equity, real estate, and infrastructure.

The late Lee Kuan Yew (1923-2015) is the Prime Minister of Singapore from 1959 to 1990, and is recognised as the nation’s founding father. He was appointed Minister Mentor in 2004 and stepped down in 2011, and was appointed Senior Advisor to the Government of Singapore Investment Corporation (GIC). He passed away in 2015.

The late Dr Goh Keng Swee (1918-2010) was the Deputy Prime Minister of Singapore and known as the “economic architect” of Singapore and is recognised as the nation’s founding father. He had held numerous portfolio, including Minister of Finance, Minister of Defence, Minister for Education, Chairman of Monetary Authority of Singapore (MAS) and Deputy Chairman of GIC. He passed away in 2010.

Lim Chow Kiat, Chief Executive Officer of GIC:

“In early 2020, the COVID-19 pandemic ushered in one of the toughest economic times in modern history. Yet, the resulting severe sell-off in global risk assets reversed course in response to the unprecedented speed and scale of government policy interventions.

Currently, with elevated asset valuations, more fragile fundamentals in the global economy and less policy room, we are cautious on the macro outlook. In contrast, we are positive on the micro prospects, given new areas of growth that are driven by increasing emphasis on sustainability, accelerating technological transformation, and growing needs for businesses to reconfigure their supply chain.

As GIC marks our 40th year in 2021, we remember the bold vision of our founding leaders, namely the late Mr Lee Kuan Yew and Dr Goh Keng Swee, who entrusted us with the mission to preserve and enhance the value of Singapore’s foreign reserves. We recommit ourselves to fulfil our mission of investing well for the long-term stability of Singapore’s finances.”

Related:

- Singapore Sovereign Wealth Fund Temasek Grows Portfolio to $283 Billion, 24% Return YOY

- Qatar $328 Billion Sovereign Wealth Fund Setup Office in Singapore

- 2020 Sovereign Wealth Fund AUM at $7.84 Trillion, Norway Largest with $1.27 Trillion

- Singapore MAS FY2020/2021 Report: AUM Reaches $3.48 Trillion

- Indonesia President Jokowi Targets $200 Billion Sovereign Wealth Fund

- New Indonesia Sovereign Wealth Fund Grows Assets to $15 Billion, Appoints First CEO

- Norway $1.05 Trillion Sovereign Wealth Fund Appoints Nicolai Tangen as New CEO

Private Equity:

- United States Private Equity Hellman & Friedman Closes $24.4 Billion Fund, $80 Billion Total Managed Assets

- 2020 China Private Equity and Venture Capital AUM at $1.04 Trillion, Southeast Asia at $33 Billion

- Hong Kong Private Equity Funds to Have 0% Tax for Carried Interest

- $342 Billion Investment Firm KKR Raises $15 Billion for Asia Fund

- World’s Leading $96 Billion Private Equity Firm Ardian Raises $19 Billion from Global Investors

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2024 Investment Day

- March 2024 - Hong Kong

- March 2024 - Singapore

- June 2024 - Hong Kong

- June 2024 - Singapore

- Sept 2024 - Hong Kong

- Sept 2024 - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Investment Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit