Japan Mizuho Financial Group Invests in Singapore Global Exchange & Marketplace for Carbon Credits Climate Impact X, Founded in 2021 by SGX, DBS, Standard Chartered & Temasek

29th November 2023 | Hong Kong

Japan Mizuho Financial Group (via Mizuho Innovation Frontier, CEO Junichi Ikeda) has announced an investment in Singapore global exchange & marketplace for carbon credits Climate Impact X (CIX), founded in 2021 by SGX (Singapore Exchange), DBS, Standard Chartered & Temasek (GenZero). Mizuho Financial Group: “Carbon credits enable companies to contribute to reducing CO2 emissions outside their own value chains, thereby directing funds towards emissions reduction efforts in emerging countries and other regions. In addition to achieving net-zero at the company level, it is vital to contribute to CO2 emissions reduction outside the company’s value chain for the achievement of net-zero at the social level. Therefore, the demand for acquiring carbon credits as a key solution is expected to increase. This agreement is based on Mizuho’s vision of the significant role that carbon credits play in decarbonisation efforts in Japan and globally, shared with CIX and the company’s four founding shareholders. The investment will be utilized to expand business in the Japanese market and further strengthen the CIX platform*, aiming to provide an environment where Japanese companies can access trustworthy carbon credits. Through our investment in CIX Mizuho will actively contribute to the development of the carbon credits market, striving to achieve carbon neutrality for our clients and society as a whole.” * The CIX platform refers to the system of the marketplace, auctions house, and exchange created by CIX.

” Japan Mizuho Financial Group Invests in Singapore Global Exchange & Marketplace for Carbon Credits Climate Impact X, Founded in 2021 by SGX, DBS, Standard Chartered & Temasek “

Bill Winters, Group Chief Executive, Standard Chartered & current Chair of the Climate Impact X (CIX) Board of Directors: “Carbon markets are a critical piece of the net zero puzzle so it’s imperative that we work together to build a high-integrity carbon market underpinned by science, strong foundations, and trust. Standard Chartered is delighted to support Climate Impact X’s ongoing efforts to enhance the credibility of the market so we can collectively use every tool available to us to reduce and remove carbon from our atmosphere. On behalf of the CIX Board, we are pleased to have Mizuho join us as a partner in advancing our collective goal of scaling the market.”

Masahiro Kihara, President & Group CEO, Mizuho Financial Group: “Mizuho supports clients’ efforts towards achieving a decarbonised society through financial and non-financial means. Carbon credits serve as a mechanism to provide funding for climate action projects and support the overall decarbonisation of society. In addition to contributing to decarbonisation efforts beyond value chains, there is an increasing importance in connecting technologies that achieve CO2 removal from the atmosphere with investors, to accelerate their implementation in society. Through this investment, we aim to provide our clients with reliable and high-quality carbon credits in partnership with CIX, and contribute to the expansion of the carbon credits market in Asia and beyond. “

Mikkel Larsen, CEO of Climate Impact X (CIX): “CIX sees Japan as an increasingly progressive market for decarbonisation solutions, including the use of carbon credits. Having a strong partner in Mizuho will allow us to meaningfully serve customers in the market. Countries rarely have a perfect match in the demand and supply of carbon credits. Enhanced connectivity is therefore important. We recognise the challenges that many leaders and companies around the world face in decarbonising; and therefore the potential for international carbon credits to supplement their efforts.”

Mizuho Financial Group, Inc. is a bank holding company and one of the world’s largest full-service financial conglomerates. With offices in over 100 locations all over the world, Mizuho Financial Group employs approximately 60,000 employees worldwide and combines 150+ years of banking experience.

Climate Impact X (CIX) is a global marketplace, auctions house and exchange for trusted carbon credits. Headquartered in Singapore with offices in London, the company is jointly owned by DBS Bank, Singapore Exchange (SGX Group), Standard Chartered and GenZero, a decarbonisation-focused investment platform founded by Temasek. CIX’s mission is to create real climate impact by turning trust in carbon credits into tangible and actionable outcomes. The company strives to enable the next wave of demand, bring desirable supply to market, facilitate price discovery, and ultimately help to unlock liquidity through a suite of solutions underpinned by integrity. CIX Marketplace simplifies the work corporate buyers need to undertake before procuring carbon credits by offering seamless access to curated projects, reducing frictions for companies just starting out and supporting corporate sustainability goals. CIX Auctions is a specialised digital venue for discovering the market value of unique and desirable, newly issued credits or customised portfolios of projects. CIX Exchange facilitates two-way trading of market-accepted standardised spot contracts and individually listed projects, concentrating liquidity and providing the market with price transparency, certainty and risk management solutions. CIX Clear is a clearing and settlement service for privately negotiated transactions, designed to reduce onboarding and counter-party risk when establishing bilateral trade relationships.

SGX, DBS, Standard Chartered & Temasek Launch New Global Exchange for Carbon Credits

21st May 2021 – Singapore Exchange (SGX), DBS, Standard Chartered and Singapore’s sovereign wealth fund Temasek, have launched a global exchange and marketplace for carbon credits. The joint venture called Climate Impact X (CIX), will be a global exchange and marketplace for high-quality carbon credits.

Climate Impact X – Platform for Carbon Credits

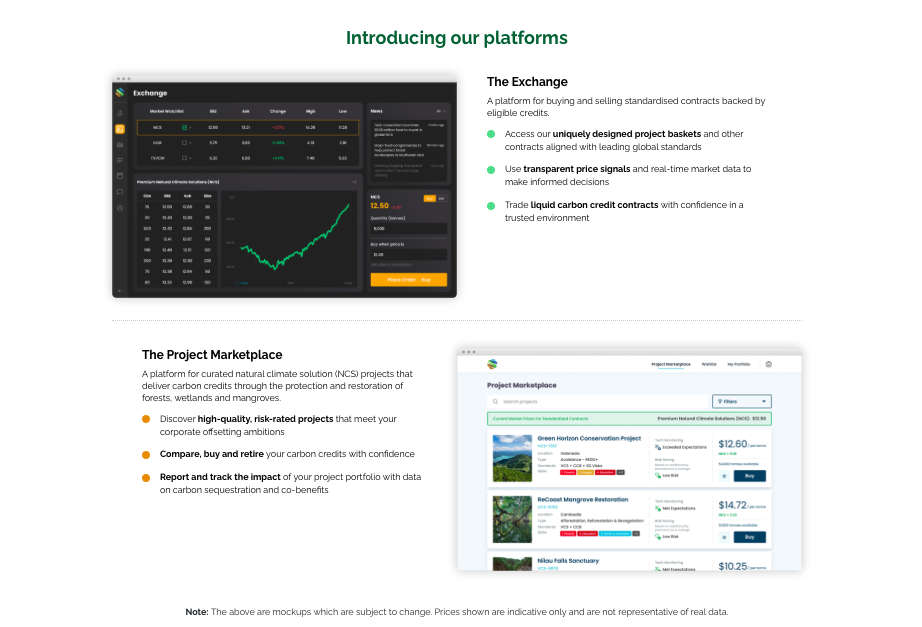

To be launched by the end of 2021, Climate Impact X (CIX) will provide platforms and products for buyers and sellers of carbon credits.

- The Exchange platform on CIX will allow multinational corporations (MNCs) and institutional investors to buy and sell large-scale high-quality carbon credits through standardised contracts.

- The Project Marketplace on CIX will allow corporates to participate in the carbon market, providing solutions such as the Natural Climate Solutions (NCS) projects to meet their sustainability objectives. Through the Project Marketplace, corporates will be supported by environmental impact, risk and pricing data.

Initial Focus of Climate Impact X

The initial focus of Climate Impact X will be on Natural Climate Solutions (NCS), which involve protection and restoration of natural ecosystems such as forests, wetlands and mangroves. Natural climate solutions are cost effective and provide significant benefits by supporting biodiversity and generating income for local communities.

Asia houses 1/3 of global supply potential and is therefore one of the largest suppliers of NCS globally. Climate Impact X will feature carbon credits from NCS projects around the world on the platform and is also in conversations with global rating agencies to provide independent ratings to these projects.

Climate Impact X – Launch Conference

At the launch of Climate Impact X were key stakeholders, including Interim CEO of Climate Impact X and DBS Chief Sustainability Officer Mikkel Larsen, DBS CEO Piyush Gupta, Standard Chartered Group CEO Bill Winters, Temasek Chief Investment Strategist Rohit Sipahimalani, SGX CEO Loh Boon Chye and SGX Head of Sustainability and Sustainable Finance Herry Cho.

- Interim CEO of Climate Impact X and DBS Chief Sustainability Officer, Mikkel Larsen

- SGX Head of Sustainability and Sustainable Finance, Herry Cho

- DBS Chief Executive Officer, Piyush Gupta

- SGX Chief Executive Officer, Loh Boon Chye

- Standard Chartered Group Chief Executive, Bill Winters

- Temasek Chief Investment Strategist, Rohit Sipahimalani

Climate Impact X, Headquartered in Singapore

Climate Impact X will be headquartered in Singapore. The joint operation of CIX by SGX, DBS, Standard Chartered and Temasek will be subject to all required regulatory approvals and consents.

Singapore Exchange is a leading exchange based in Singapore, providing listing, trading, clearing, settlement, depository and data services in securities, derivatives, currency and commodity market.

DBS is a leading financial services group in Asia with a presence in 18 markets and Standard Chartered is a leading international banking group, with a presence in 59 of the world’s most dynamic markets, and serving clients in a further 85 markets.

Temasek is the sovereign wealth fund of Singapore, and an investment company with a net portfolio value of S$306 billion (US$214 billion) as at 31 March 2020.

Climate Impact X – International Advisory Council

Climate Impact X will be guided by an International Advisory Council – an independent expert body comprising non-governmental organisations, leading corporates and project developers, and academics and thought leaders.

CIX will also work with an ecosystem of global partners and international working groups, including the Taskforce on Scaling Voluntary Carbon Markets (TSVCM) and the Natural Climate Solutions Alliance, to align on leading standards for quality and integrity.

Interim CEO of Climate Impact X and DBS Chief Sustainability Officer, Mikkel Larsen:

“Climate Impact X will provide a solution for corporates to address unavoidable carbon emissions in the near term and propel the development of new carbon credit projects worldwide. With an initial focus on Natural Climate Solutions, the carbon credits will also create impetus to address another grave risk of biodiversity loss and help serve local communities.

CIX will build on collective action by global governments, corporates and individuals to achieve a net-zero economy. By facilitating a well-functioning marketplace with strong impact and risk data, CIX will enable efficient price discovery and catalyse the development of new projects.”

DBS Chief Executive Officer, Piyush Gupta:

“It is becoming increasingly apparent that the world requires a carbon market of the highest international standards. As a leading global financial and trading hub, supported by strong regulatory frameworks, Singapore is well placed to lead such sustainability efforts.

To catalyse the development of new carbon credit projects, there is a need for more high-quality carbon credits and the active cross border trading of such credits to drive global price transparency. We look forward to galvanising change by gathering like-minded industry leaders to a centralised world-class platform, scaling the global voluntary carbon market and expediting the transition to a low-carbon economy.”

SGX Chief Executive Officer, Loh Boon Chye:

“ SGX serves the ecosystem as a leading sustainable and transition financing and trading hub. Climate action is a key priority for us and we support internationally accepted carbon mitigation hierarchies. From avoiding and reducing emissions within companies’ operations and value chains, to using renewable energy sources wherever possible and finally neutralising and compensating for hard-to-abate emissions, we will work with our ecosystem throughout this journey.

Climate Impact X will be an integral part of this vision, backed by SGX’s track record as a major price discovery venue for global commodities and Singapore’s strong and trusted financial infrastructure.”

Standard Chartered Group Chief Executive, Bill Winters:

“Standard Chartered operates in many of the world’s fastest-growing economies across Asia, Africa and the Middle East, which are home to a high proportion of the world’s natural climate solutions. To meet our shared climate objectives, we need to see a significant capital shift to these markets to protect nature and enable a sustainable low-carbon transition.

Voluntary carbon markets are necessary to accomplish this transfer efficiently and, as set out in the work of the Taskforce on Scaling Voluntary Carbon Markets, we must agree to a consistently high standard of carbon credits for this market to be credible and effective. This is the decade for action, and we are confident that Climate Impact X will play a critical role in aligning the planet’s emissions profile to a net-zero future.”

Temasek Chief Investment Strategist, Rohit Sipahimalani:

“Temasek is committed to generating positive impact on people and the planet through our global investments. We provide capital to catalyse new ideas and solutions.

Climate Impact X aligns with our commitment to invest in businesses that will yield positive climate benefits as well as developments in their broader ecosystems for the long term. We are pleased that the platform will help organisations to address their carbon footprints through both market and natural climate solutions.”

Related:

- Deutsche Bank Survey: 75% of Private Bank Clients View Investments Should Have Positive Impact to the World

- The Future of Capital is Green – Keynote Address by Ravi Menon at IMAS-Bloomberg Investment Conference 2021

- Hong Kong Exchange Launches Sustainable and Green Exchange

- 2020 Annual Impact Investor Survey – Global Impact Investing $715 Billion Market Maturing

- IFC Releases The 2020 Growing Impact Report

- BNP Paribas Survey: 40% of Hedge Funds in Survey Consider ESG Factors in Investment Process

- UBS Tightens Carbon Asset Financing, Zero Emissions by 2050

About Climate Impact X

About Climate Impact X

Climate Impact X (CIX) will be a Singapore-based global carbon exchange and marketplace that aims to scale the voluntary carbon market. CIX will connect an ecosystem of partners, leveraging satellite monitoring, machine learning and blockchain to enhance transparency, integrity and quality of carbon credits. This will empower corporations to take effective action and complement carbon reduction efforts as part of a holistic climate mitigation strategy. CIX will offer distinct platforms and products that will cater to the needs of different carbon credit buyers and sellers.

The Exchange will facilitate the sale of large-scale high-quality carbon credits through standardised contracts – catering primarily to MNCs and institutional investors. The Project Marketplace will offer a curated selection of NCS projects that can meet corporate sustainability objectives. Each project on the Project Marketplace will be supported by transparent impact, risk and pricing data.

For more information, please visit www.climateimpactx.com

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2024 Investment Day

- March 2024 - Hong Kong

- March 2024 - Singapore

- June 2024 - Hong Kong

- June 2024 - Singapore

- Sept 2024 - Hong Kong

- Sept 2024 - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Investment Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit