5 Wealth Management Jobs where you get to Trade often

No. 1 Stock Broker / Dealer / Remisier

The Broker gets to buy & sell stocks everyday for clients. The stock market is the hottest financial instrument. Hot stock markets in Asia are Hong Kong, Singapore and Japan. These are the most open & active financial stock markets for any investors.

Talk about the latest IPOs, takeover targets, quarterly profit, announcements, bankruptcies and sometimes inside news. This is everyday action and when the hour gets hot, the phone rings every minute.

Check out Peter Lim from Singapore – the Remisier King.

Instruments: Stocks, Bonds, FX, Commodities, Forwards, Futures

- Activity: High

- Trading Skills Required: High

- Possible Employers: Stock Brokerage, Banks

No. 2 Treasury Advisor

The Treasury Advisor has become an important role in Wealth Management.

In every country and banks, there is a Treasury department. The Treasury department manages the money exposure of currencies, cash flow, reserves and interest rates. Now this treasury expertise is available in Wealth Management in most banks.

The Treasury Advisor talks about the latest announcement by Central Banks around the world, tracks the economic forecasts daily and turn them into insightful daily investment ideas. Participate in the USD 5 Trillion forex market through SGD, USD, EUR, GBP, AUD, NZD or the up & coming CNY (Chinese Yuan).

Treasury Advisors trade millions to hundred millions a day in many financial instruments. Just don’t make an error as a $1 Million trade can cost a $5K to $10K loss in a second.

Instruments: Stocks, Bonds, FX, Gold, Silver, Swaps, Options, Forwards, Futures

- Activity: High

- Trading Skills Required: High

- Possible Employers: Banks

No. 3 Investment Advisor

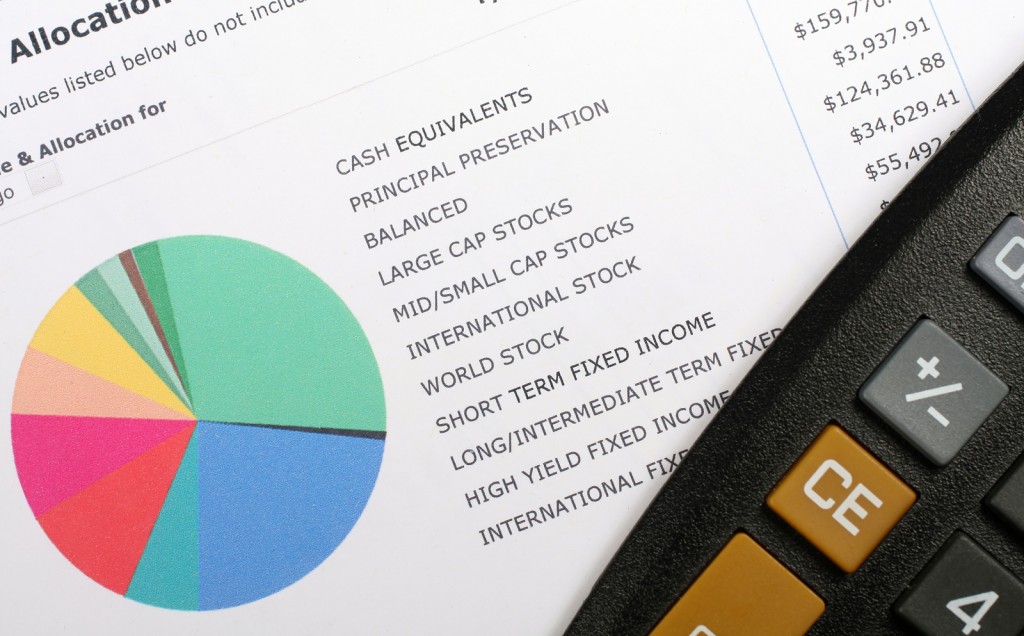

The Investment Advisor is more a portfolio advisor than a trader. A strong advocator for traditional portfolio investments and preaches about asset allocation and tactical allocation.

The key word is tactical allocation. Tactical allocation involves looking at short-term investment opportunities. How are these investment insights & opportunities be turned into investment action in the short-term?

Through trading, the Investment Advisor takes on an active role to invest a fraction of the portfolio into any sector and ideas that will move within a short period of time.

The value of investment for long-term trades is large, while the value of short-term trades is much lower. That changes when leverage or gearing are used in the short-term.

Instruments: Unit Trust, Stocks, Bonds, FX, Gold, Silver, Swaps, Options, Forwards, Futures

- Activity: Medium

- Trading Skills Required: Medium

- Possible Employers: Stock Brokerage, Banks

No. 4 Private Banker

Private Banker manages money for high net worth clients. The Private Banker handles more than just investments and portfolio management.

High net worth clients comes from diverse background and are incredibly successful, if not only financially. The Private Banker provide services in asset structuring, international estate planning, credit services, corporate needs, networking or other personalized services which may be off the job scope to fulfil client’s financial needs.

Due to the complex financial needs, the Private Banker takes on any kind of trades and also sophisticated trades for clients with support from Treasury Advisor and Investment Advisor.

Sometimes, things don’t go too well.

- Dinner with Private Banker cost him $34 Million with Goldman Sachs

- Losing a $1 Billion Trade with Citi Private Bank

Instruments: Unit Trust, Stocks, Bonds, FX, Gold, Silver, Swaps, Options, Forwards, Futures

- Activity: Medium

- Trading Skills Required: Low

- Possible Employers: Banks, Private Banks, Independent Asset Manager

No. 5 Priority Banker

A Priority Banker manages money for affluent clients. Affluent clients are clients with increasing and accumulating wealth. Due to their growing wealth, they are now given opportunities in more investment options than the typical retail clients.

Here comes the trading action for the Priority Banker. Given that the client is likely new to many financial instruments, the Priority Banker will have to act as the educator and trading advisor to client.

Like most investors, most clients prefer short holding period and hopefully, high returns that is reasonable. Though that is a tall order to match, it is possible with the range of financial instruments available in Priority Banking.

The most common trades are Equity Linked Notes (Stocks + Options) and Currency Linked Notes (Currency + Option).

Instruments: Unit Trust, Stocks, Bonds, FX, Gold, Silver, Forwards, Options

- Activity: Low

- Trading Skills Required: Low

- Possible Employers: Banks

Definition

Activity (seasonally adjusted for 252 business days)

- Low: less than 5 trades a day

- Medium: 6 – 20 trades a day

- High: > 21 trades a day

Trading Skills

- Low: Able to buy & sell trades with trading volume error execution of less 1%

- Medium: Able to buy & sell trades with trading volume error execution of less 1% and ability to spot & reconcile errors

- High: Able to buy & sell trades with trading volume error execution of less 0.5%, ability to spot & reconcile errors, and able to maintain P&L books for department or individual.

Best Practices

Most financial institutions will have 2 initial triggers or checks for every trade. After the trade had been completed, there will be another 2 checks or reconciliation.

Other factors

- Number of Clients Per Advisor (affects the time of advisor to trade)

- Average Trading Size (affects the motivation to advise)

- Average Revenue (affects the motivation to advise)

Related Articles:

- 20 Traders Who Lost More than a Billion

- Top 30 Trading Terms

- 10 Trading Quotes from the 5 Greatest Traders of All-Time

- 15 Popular Sectors for Wealth and Investment Professionals

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2024 Investment Day

- March 2024 - Hong Kong

- March 2024 - Singapore

- June 2024 - Hong Kong

- June 2024 - Singapore

- Sept 2024 - Hong Kong

- Sept 2024 - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Investment Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit